What Is A Pullback?

In technical analysis, a pullback refers to a temporary reversal in the direction of the price of a given asset. This usually happens after a prolonged uptrend or downtrend and typically represents a brief pause in the market before the trend continues.

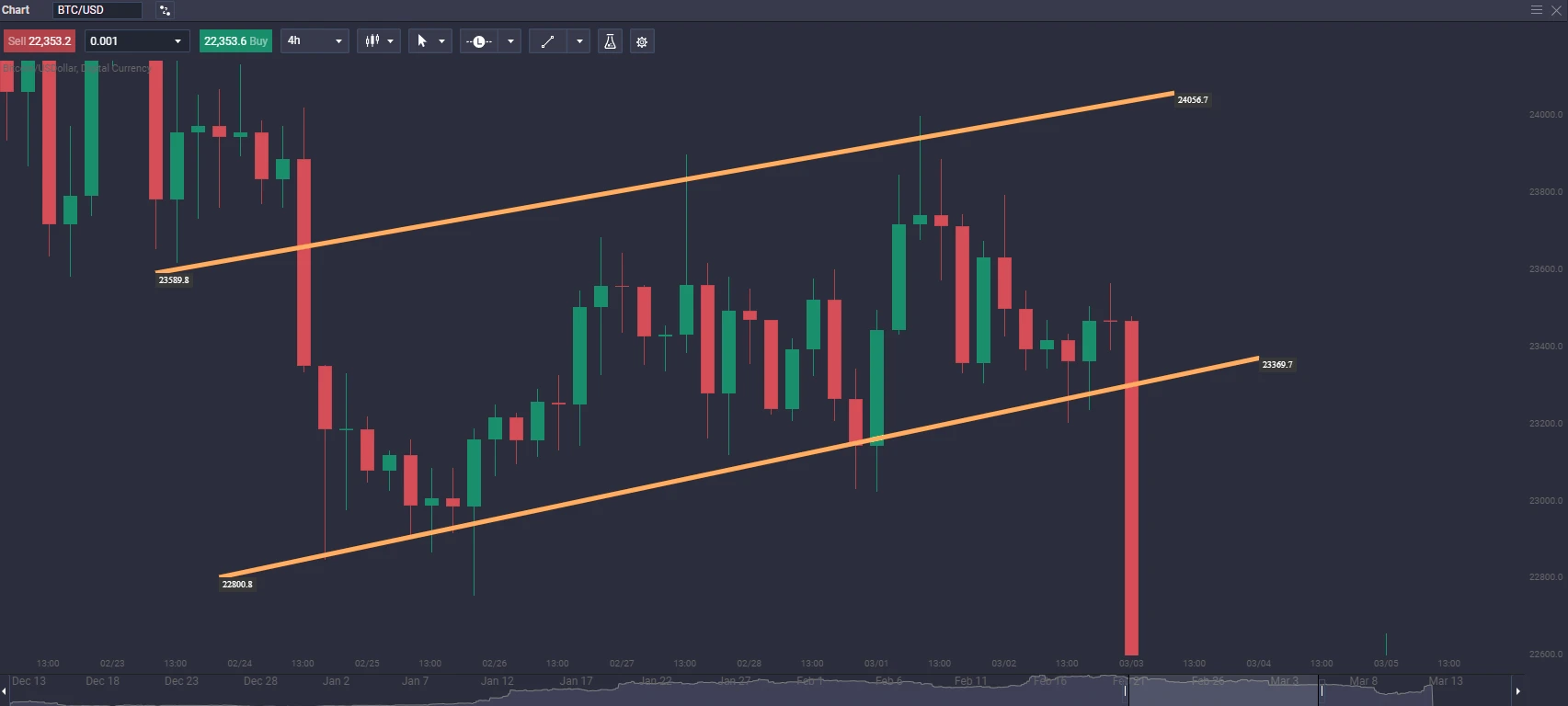

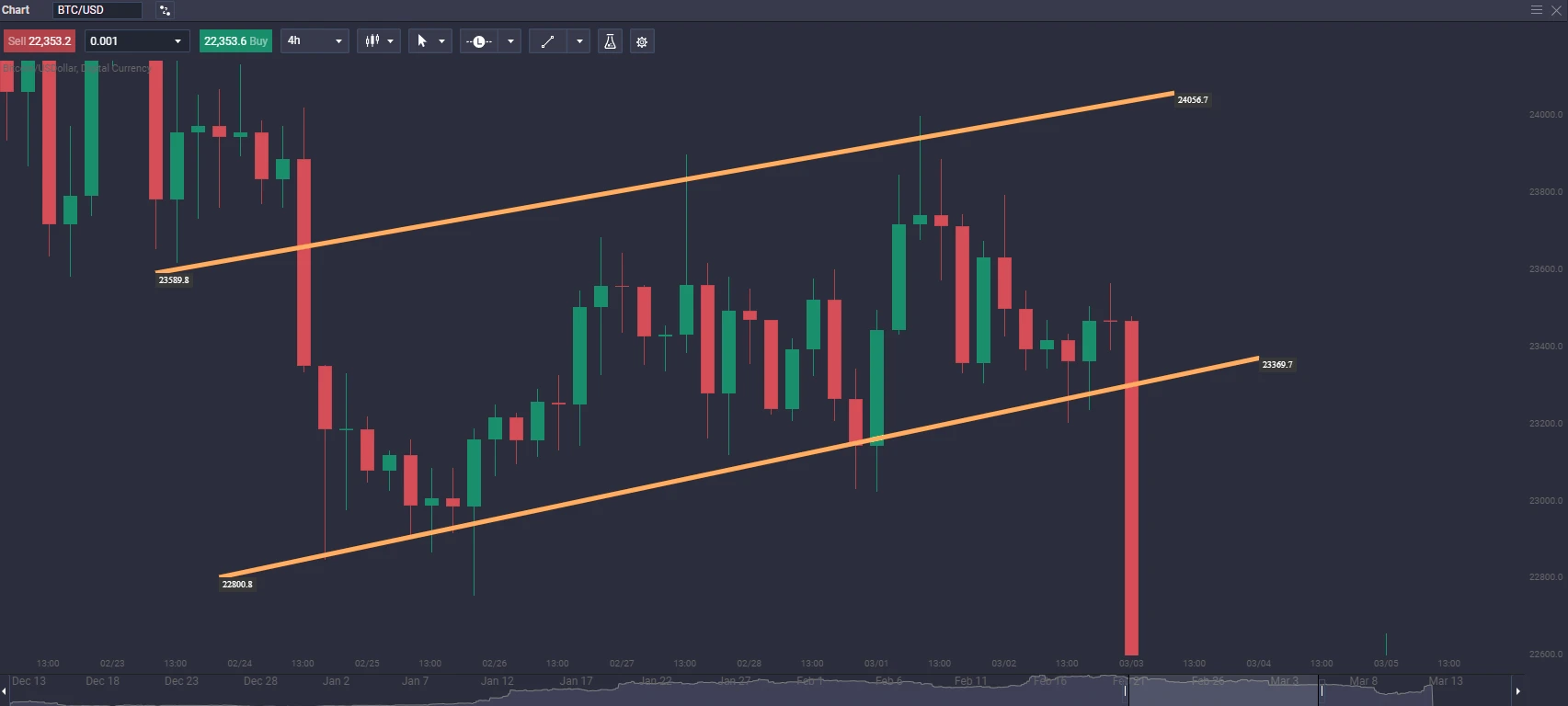

Imagine you’re observing bitcoin’s movement, and the price has steadily increased for several days. However, you may notice that the price briefly dips or retraces at certain points before resuming its upward trend. This retracement is known as a pullback.

When Do Pullbacks Occur?

A pullback could happen if there is a sudden increase in selling pressure or some investors decide to take profits by selling their BTC stash. Since the price can continue its uptrend after a temporary correction, pullbacks could provide buying opportunities for investors.

However, it is worth noting that pullbacks can also signal a potential trend reversal, so traders must carefully monitor market conditions and use appropriate risk management strategies to protect their trades.

Traders can use different tools, such as trend lines, moving averages, and indicators like the Relative Strength Index (RSI) to identify potential pullbacks and determine whether they are temporary corrections within a larger trend or signs of a trend reversal.

Overall, pullbacks are pretty tricky to predict, and they can cause anxiety for traders since they could denote a buying opportunity or a trend reverse. Nonetheless, understanding the concept of pullbacks is essential to crypto trading and can help traders make more informed decisions about when to enter or exit a trade.