In trading, a breakout refers to when the price of an asset breaks through a strong support or resistance level.

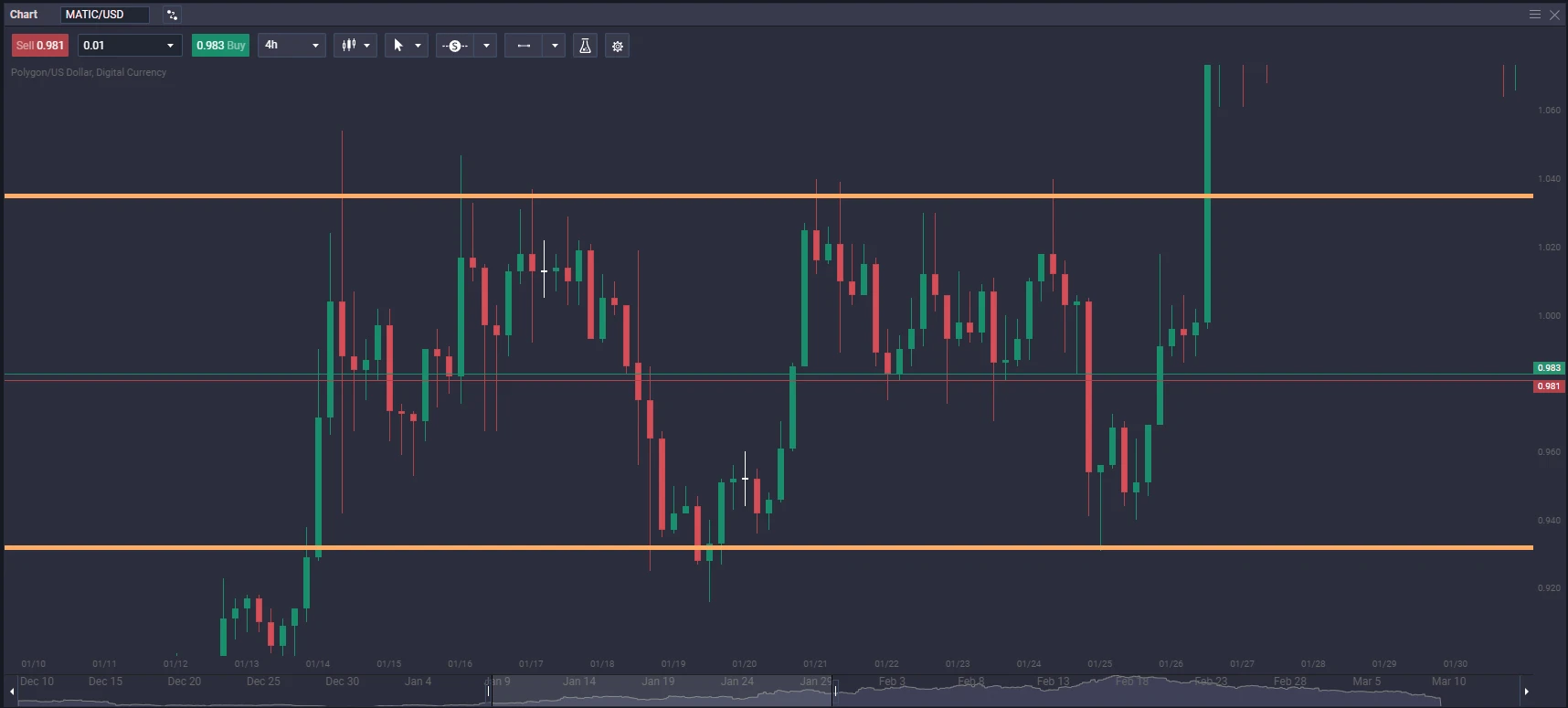

As discussed in previous lessons, support is like a floor that prevents the price from falling further, while resistance is like a ceiling that stops the price from moving higher. Buying pressure is high at the support level, and the price is expected to bounce back, while there is selling pressure at the resistance level, and the price is expected to fall. A breakout can occur in either direction; it is usually accompanied by high trading volumes.

For example, imagine the bitcoin price has been trading between $25,000 and $30,000 for several weeks, with $25,000 acting as a support level and $30,000 serving as a resistance level. If the price of bitcoin suddenly rises above $30,000 and stays there for an extended period, this would be considered a breakout above the resistance level.

A breakout above a significant resistance area can be a strong bullish signal, indicating that there is buying pressure in the market and that the price may continue to rise. In contrast, a breakout below significant support, known as a breakdown, can be a strong bearish sentiment, as more traders are offloading their portfolios in the market, which could cause the price to continue to fall.

Like pullbacks, you can use tools like trend lines, moving averages, and indicators to identify potential breakouts and determine their sustainability.

With that said, breakouts can help traders decide whether or not it is profitable to long or short the market.